[ad_1]

By Subhadip Sircar

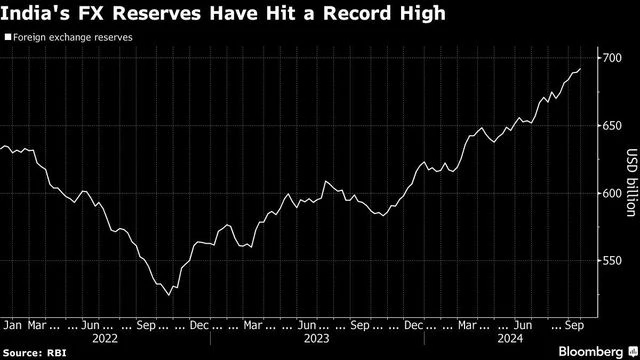

India’s foreign-exchange reserves will likely rise to $745 billion by March 2026, giving the central bank more potential firepower to influence the rupee, according to Bank of America.

Click here to connect with us on WhatsApp

The monetary authority “seems relaxed about holding larger forex reserves, owing to its desire to build buffers against contingent external risks,” BofA analysts Rahul Bajoria and Abhay Gupta wrote in a note Friday. India’s reserves adequacy appears strong compared with other major emerging markets, but not necessarily excessive, they said.

India has the world’s fourth-biggest foreign reserves at $692 billion as rising overseas inflows into the nation’s stocks and bonds have helped the Reserve Bank of India boost its stockpile to a record high. The amount provides stability to the rupee against external shocks, with the RBI using its reserves to limit extreme swings in the currency hovering near a record low.

)

The growth in FX reserves will be driven by a balance-of-payments surplus, owing to a smaller current-account deficit, the analysts wrote.

RBI Governor Shaktikanta Das has repeatedly stressed the need to build a forex buffer to act as a shield during periods of market volatility.

“USD/INR‘s wider daily ranges recently have created some wiggle-room for limited INR appreciation, and higher volatility compared to over the past year,” Bajoria and Gupta wrote. “However, the RBI can simultaneously attain its multiple objectives of building a larger reserves buffer and maintaining currency competitiveness, while allowing limited bilateral INR appreciation.”

First Published: Oct 04 2024 | 3:37 PM IST

[ad_2]

Source link